Last week we looked at how to Create a $100 Debt Snowball.

Today we are going to reap the benefits and sow the rewards of that effort.

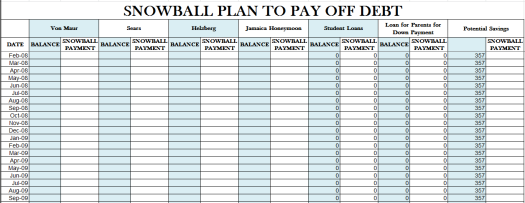

By October of 2004, I am paying $307 monthly on student loans.

Making quick progress, by October 2005, I eliminate the student loans at the remaining $296 and immediately apply the left over $61 to the last remaining debt – the loan to my parents for the down payment on our house.

296+61=50 = $357

The next month, November 2005, I pay the entire $357 on the down payment loan…until the last debt is decimated in August 2007.

See all of those zeros? Those are the months I was projected to be paying on these debts, paying the minimum amount due.

Instead, I put that money into a savings account. Starting in July 2007, I finish off the payment with $199 and immediately put the remaining $156 in savings. The very next month, I put the entire $357 to savings and continue the whole time I was projected to be paying on these debts at the minimum payment due.

Wait, Hold up. Did you catch that? >>> $45,854.

Look at how much money we keep when we pay it to ourselves instead of the banks, to our dreams instead of our debts.

Speaking of our dreams – what was our dream list? Let’s check out our WHY. What could we have done with that money instead – what experiences, memories, travels, improvements could we have instead?

Top 5 Big Dreams >>>

Jamaica $4,600

Kids to Disney World $7,000

Dream House – WHO KNOWS??!

Australia $10,000

Attend the Music Awards $3,500

We could have done most of these big, crazy dreams with $20,754.00 left over for a down payment on our dream house for the same amount of money in the same amount of time with very little intensity and zero income increases.

For more on the debt snowball, see all things Dave Ramsey.

ACTIONABLE STEP:

Email me for a working example of my spreadsheet. I want to share it with you!

Add $100 to the minimum payment until the first debt is wiped out, add all that money to the next lowest debt, continue through your pay-off schedule until all the debt is wiped out. See how much time you have snatched back for your financial freedom.

Just for fun, when the largest, last debt is wiped out, continue to place that money in a projected savings column. Continue to do that through your original minimum pay off date. Look at that number. Feel it pulse through you.

That is what debt costs you.

Now go back to your WHY. How many of those items could be accomplished within the time frame that was originally set aside for minimum debt payments?

Now, think on that a bit. What items can you check off your dream list by paying just $100 more per month on your lowest debt?

BONUS POINTS: Send me an email artofloveandmoney@gmail.com to become one of my case studies. If you are chosen, you will receive a free 15 minute personal finance coaching session via skype and your case study will be spelled out for you in the system that I used to walk our family out of the red and into the black.

.